Plunging prices have neither halted oil production nor stimulated a surge in global growth

OIL traders are paying unusual attention to Kharg, a small island 25km (16 miles) off the coast of Iran. On its lee side, identifiable to orbiting satellites by the transponders on their decks, are half a dozen or so huge oil tankers that have been anchored there for months. Farther down Iran’s Persian Gulf coast is another flotilla of similarly vast vessels. They contain up to 50m barrels of Iranian crude—just what a world awash with oil could do without.

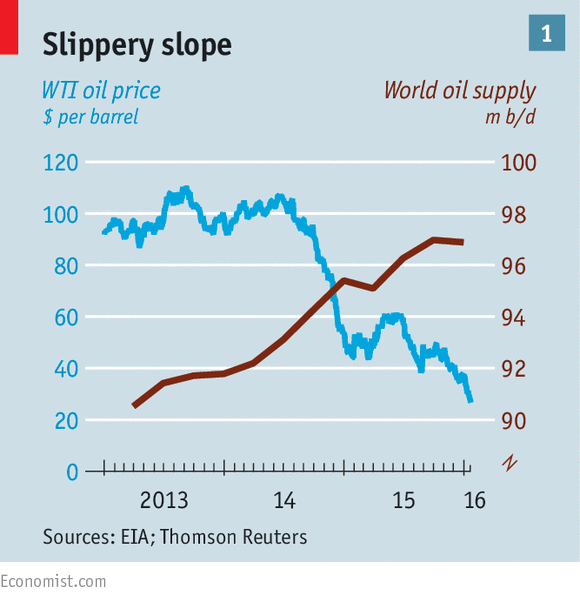

The lifting of nuclear-related sanctions against Iran on January 16th puts those barrels at the forefront of the country’s quest to recapture a share of international oil markets that it has been shut out of for much of the past decade. The prospect of Iran swiftly dispatching its supertankers to European and Asian refineries to undercut supplies from Saudi Arabia, Iraq and Russia helped push the world’s main benchmarks, Brent and West Texas Intermediate (WTI), to their lowest levels since 2003 on January 20th; WTI tumbled by 6.7% to under $27 a barrel, its biggest one-day fall since September (see chart 1).

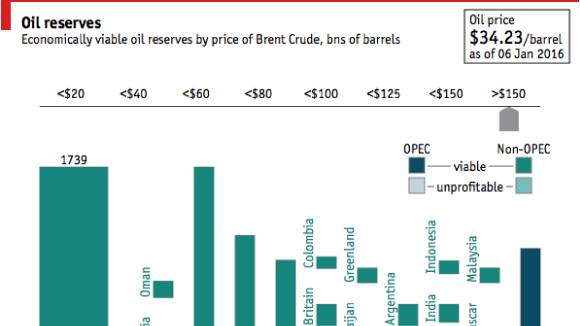

The slide marks the latest act in a dramatic reversal of fortunes for the oil industry that is, in turn, roiling the global economy. Less than a decade ago the world scrambled for oil, largely to fuel China’s commodity-hungry growth spurt, pushing prices to over $140 a barrel in 2008. State-owned oil giants such as Saudi Aramco had access to the cheapest reserves, forcing private oil firms to search farther afield—in the Arctic, Brazil’s pre-salt fields and deep waters off Angola—for resources deemed ever scarcer. Investors, concerned that the oil majors could run out of growth opportunities, encouraged the search for pricey oil, rewarding potential future growth in production as much as profitability.

Now the fear for producers is of an excess of oil, rather than a shortage. The addition to global supply over the past five years of 4.2m barrels a day (b/d) from America’s shale producers, although only 5% of global production, has had an outsized impact on the market by raising the prospects of recovering vast amounts of resources formerly considered too hard to extract. On January 19th the International Energy Agency (IEA), a prominent energy forecaster, issued a stark warning: “The oil market could drown in oversupply.”

Last year the world produced 96.3m b/d of oil, of which it consumed only 94.5m b/d. So each day about 1.8m barrels went into storage tanks—which are filling up fast. Though new storage is being built, too much oil would cause the tanks to overflow. The only place to put the spare barrels would be in tankers out to sea, like the Iranian oil sitting off Kharg, waiting for demand to recover.

For oil producers that is an alarming prospect, yet for the most part warnings such as those of the IEA have gone unheeded. This poses two puzzles. When, in November 2014, Saudi Arabia forced OPEC to keep the taps open despite plummeting prices, it hoped quickly to drive higher-cost producers in America and elsewhere out of business. Analysts expected a snappy rebound in prices. Though oil firms have since collectively suspended investment in $380 billion of new projects, as yet there is no sign of a bottom. Projections for a meaningful recovery in the oil price have been pushed back until at least 2017.

The economic impact of the oversupply is another enigma. Cheaper fuel should stimulate global economic growth. Industries that use oil as an input are more profitable. The benefits to consuming nations typically outweigh the costs to producing ones. But so far in 2016 a 28% lurch downwards in oil prices has coincided with turmoil in global stockmarkets. It is as if the markets are challenging long-held assumptions about the economic benefits of low energy prices, or asserting that global economic growth is so anaemic that an oil glut will do little to help.

Iran is the most immediate cause of the bearishness. It promises an immediate boost to production of 500,000 b/d, just when other members of OPEC such as Saudi Arabia and Iraq are pumping at record levels. Even if its target is over-optimistic, seething rivalry between the rulers in Tehran and Riyadh make it hard to imagine that the three producers could agree to the sort of production discipline that OPEC has used to attempt to rescue prices in the past.

Even if OPEC tried to reassert its influence, the producers’ cartel would probably fail because the oil industry has changed in several ways. Shale-oil producers, using technology that is both cheaper and quicker to deploy than conventional oil rigs, have made the industry more entrepreneurial. Big depreciations against the dollar have helped beleaguered economies such as Russia, Brazil and Venezuela to maintain output, by increasing local-currency revenues relative to costs. And growing fears about action on climate change, coupled with the emergence of alternative-energy technologies, suggests to some producers that it is best to pump as hard as they can, while they can.

This is not the first time OPEC has overestimated the effectiveness of what, during the era of John Rockefeller’s Standard Oil, used to be called “a good sweating”: attempting to flood the market with cut-price oil to drive competitors out of business. In the mid-1980s the cartel sought to use low prices to undercut producers in the North Sea, but failed. They enacted a policy to recoup market share from their non-OPEC rivals, but ended up trying to defeat each other, further weakening prices. It took several years for oil prices to recover.

It’s a time-worn miscalculation. In his book “The Prize”, Daniel Yergin quotes an American academic writing as far back as 1926 about the “spectacle” of massive overproduction. “Oil producers were committing ‘hara-kiri’ by producing so much oil,” the scholar wrote. “All saw the remedy but would not adopt it. The remedy was, of course, a reduction in the production.”

Yet there is also a reason for keeping the pumps working that is not as suicidal as it sounds. One of the remarkable features of last year’s oil market was the resilience of American shale producers in the face of falling prices. Since mid-2015 shale firms have cut more than 400,000 b/d from output in response to lower prices. Nevertheless, America still increased oil production more than any other country in the year as a whole, producing an additional 900,000 b/d, according to the IEA.

During the year the number of drilling rigs used in America fell by over 60%. Normally that would be considered a strong indicator of lower output. Yet it is one thing to drill wells, another to conduct the hydraulic fracturing (“fracking”) that gets the shale oil flowing out. Rystad Energy, a Norwegian consultancy, noted late last year that the “frack-count”, ie, the number of wells fracked, was still rising, explaining the resilience of oil production.

The roughnecks used other innovations to keep the oil gushing, such as injecting more sand into their wells to improve flow, using better data-gathering techniques and employing a skeleton staff to keep costs down. The money is no longer flowing in. America’s once-rowdy oil towns, where three years ago strippers could make hundreds of dollars a night from itinerant oilmen, are now full of abandoned trailer parks and boarded-up businesses. But the oil is still flowing out. Even some of the oldest shale fields, such as the Bakken in North Dakota, were still producing at the same level in November as more than a year before.

The shale industry also benefited from financial engineering. Last year at least half of the firms involved had hedged the oil price to protect revenues. Some went bankrupt, but most have managed to sweet-talk bankers into keeping the credit flowing—at least until the latest crisis.

It is not just the shale industry that managed to keep its head above water longer than expected. Those extracting in more expensive places, such as Canada’s oil sands and Brazilian pre-salt, have too. Canada, whose low-quality benchmark oil, West Canada Select, is trading below $15 a barrel, giving it the ignominious title of the world’s lowest-value crude, is one of the non-OPEC countries expected to add most to global supply this year. So is Brazil, despite debt and corruption at its state oil company, Petrobras.

Meanwhile, the oil majors have said they will slash tens of thousands of jobs and billions of dollars in investment, but they too are reluctant to abandon projects that may add to future production. Shell, an Anglo-Dutch company, took the rare decision to abandon exploration in the Arctic and a heavy-oil project in Canada but its current output of 2.9m b/d in 2015 was only just shy of the previous year’s 3.1m b/d. In the industry at large, the incentive is to keep producing “as flat out as you can”, once investment costs have been sunk into the ground, says Simon Henry, Shell’s chief financial officer. He says it is sometimes more expensive to stop production than to keep pumping at low prices, because of the high cost of mothballing wells.

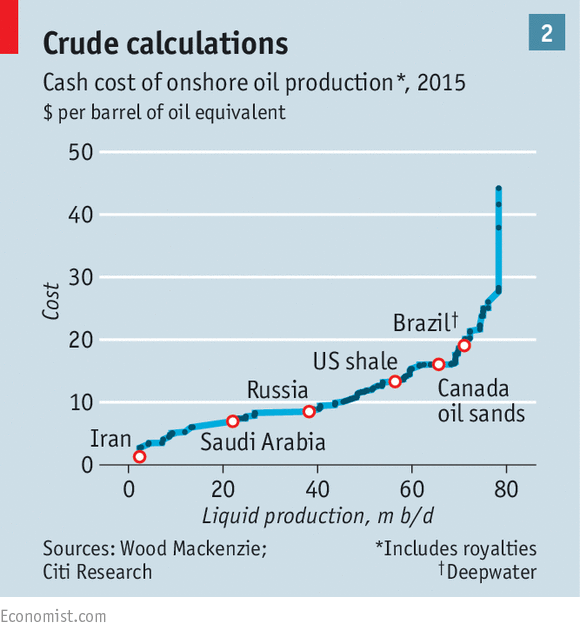

Simon Flowers of Wood Mackenzie, an industry consultancy, says that even at $30 a barrel, only 6% of global production fails to cover its operating costs. It may be uneconomic to drill new deepwater wells at prices under $60 a barrel, he says, but once they are built it may still make economic sense to keep them running at prices well below that (see chart 2). Such resilience is used by some to justify why they expect prices to remain “lower for longer”.

In theory a long period of low oil prices should benefit the global economy. The world is both a producer and a consumer: what producers lose and consumers gain from a drop in prices sums to zero. Conventionally, extra spending by oil importers exceeds cuts in spending by exporters, boosting global aggregate demand.

The economies that have enjoyed the strongest GDP growth in the past year have indeed been oil importers: India, Pakistan and countries in east Africa. It is hard to explain the consumer-led recovery in the euro area without assuming a positive impact from lower oil prices. In the IMF’s latest forecast, published on January 19th, the handful of big economies that were spared downgrades to GDP growth—China, India, Germany, Britain, Spain and Italy—were all net oil importers.

Where are the windfalls?

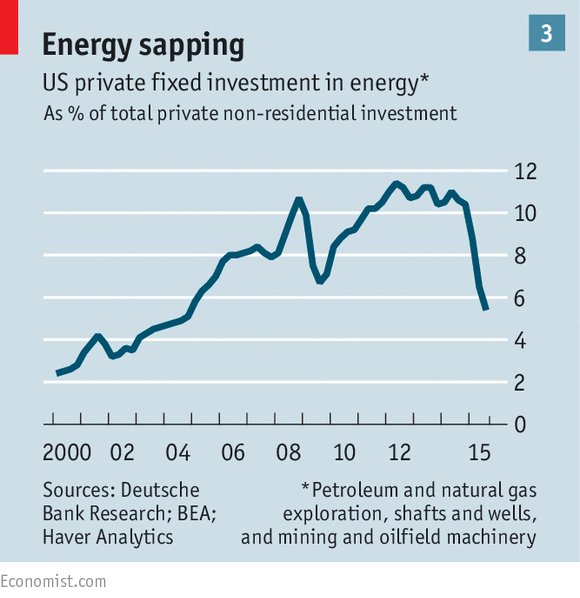

There are doubts that this holds true everywhere. America is both a large producer and consumer of oil. At the start of 2015, JPMorgan, a bank, reckoned that cheap oil would boost GDP by around 0.7%—a boost to consumers’ purchasing power equivalent to 1% of GDP, offset by a smaller drag from weaker oil-industry investment. It now reckons the outcome was between a contraction of 0.3% and a boost of a measly 0.1%. Consumers may have saved more of the windfall than had seemed likely and the share of oil-related capital spending in total business investment in America, which had steadily risen for years, has fallen by half (see chart 3).

Add in the indirect effects of the downturn in the oil industry and the net impact of cheap oil may even have been a bigger decline than JPMorgan’s most pessimistic estimate. That has been the experience of the MSC Industrial Supply Company, an American retailer of hinges, brackets, power tools and maintenance equipment to manufacturers. It does not rely directly on orders from oil companies, yet this month its boss, Erik David Gershwind, said that fallout from the oil shock had had a noticeable impact on sales. “The indirect exposure is, I think, what’s taken everybody by surprise, not only at MSC but in the broader economy, and it’s ugly.”

Unsurprisingly some of the biggest splashes of red ink in the IMF’s latest forecast revisions were reserved for countries where oil exploration and production has played a significant role in the economy: Brazil, Saudi Arabia, Russia (and some of its oil-producing neighbours) and Nigeria. Weaker demand in this group owes much to strains on their public finances.

Russia has said it will cut public spending by a further 10% in response to the latest drop in crude prices (see article). The oil industry accounts for 70% of tax revenue in Nigeria. When the oil price plunged in 2008-09, it was able to draw on savings it had salted away in an oil-stabilisation fund. But in June the country’s president, Muhammadu Buhari, said the treasury was “virtually empty”. Saudi Arabia has deeper pockets but, with a budget deficit that reached 15% of GDP last year, even it has been forced to cut public spending.

The old calculus that such countries were able to smooth spending through the oil-price cycle has become less reliable. To a larger degree than in the past, oil producers have spent windfall revenues, and now have been forced to cut back. This compounds the effect on aggregate demand of falling investment in the oil industry.

Perhaps more worrying is the way the oil-price drop is compounding the effect of financial fragility worldwide. Low interest rates in America and Europe after 2009 drew rich-world investors into emerging markets, creating a lending boom. Corporate debt in emerging markets rose from 50% of GDP in 2008 to 75% in 2014. The lesson of recent history is that a rapid build-up in debt leads to trouble. Along with construction, the oil and gas industry saw a big increase in corporate debt, according to the IMF’s latest Global Financial Stability Report. Lower oil revenues make it harder to service this burden.

When the oil price slumped in 2008-09 oil-producing countries were able to cut interest rates and borrow abroad to prop up demand. Now investors are charier of risk. The end of the Federal Reserve’s programme of bond buying (“quantitative easing”) in 2014 and the recent increase in interest rates has drawn money back to America, boosting the dollar and tightening global monetary conditions.

Oil producers, notably in Latin America, are having to tighten domestic monetary policy to tackle inflation, in part caused by big falls in their currencies. Brazil’s central bank has kept interest rates high, even though its economy is deep in recession. Central banks in Colombia and Mexico raised rates in December. The same strains are evident in oil-rich Nigeria and Angola, the largest and third-largest economies in sub-Saharan Africa. The easier financial conditions in the years after 2009 gave policymakers in Africa a false sense of their own resilience, says Stuart Culverhouse of Exotix, a broker.

Investors appear to be rethinking how risky assets should be priced in rich countries, too. This is as much a response to concerns about the strength of China’s economy as to the damage a sharp fall in oil prices might wreak. Worries about delinquent borrowers in the oil industry triggered a sharp rise in their yields in America’s junk-bond market at the end of last year. The yields on junk bonds issued by other sorts of borrowers rose in apparent sympathy. Even yields on investment-grade bonds are edging up.

Stockmarket bears are quick to point out that higher real interest rates on corporate bonds make it harder to justify elevated share prices. Central bankers in rich countries say they worry that a long period of near-zero inflation is entrenching beliefs that prices will remain endlessly flat. The real rate of interest rises when expectations of inflation fall and it is hard for policymakers to respond to this as rates are already close to zero.

Since the start of the year, the supply shock from Iran has also been accompanied by fears of a demand one from China. The bungled handling of China’s stockmarket and currency has raised fears about the economy, which has spilled over into the oil market. As global financial markets have descended into turmoil, there are mounting worries about the resilience of the global economy, too. That, in turn, raises anxiety about future oil demand.

Macroeconomic concerns are paramount, but there are also microeconomic ones. Lower fuel subsidies in some oil-producing countries, aimed at plugging budget deficits, are encouraging car owners to drive less miles. China has said that it will not allow petrol prices to fall in line with oil below $40 a barrel, which will have the same effect. Even in the United States, the link between cheap petrol and gas-guzzling is less strong than it was. Part of the reason, analysts say, is that vehicles are more fuel-efficient.

Green and black

After the Paris summit on climate change in December some pundits reckon that the latest oil crisis reflects a structural change in oil consumption because of environmental concerns—what some call “peak demand”. It is true that as climate consciousness grows, oil companies are developing more gas than oil, hoping to deploy it as an energy substitute for coal. But it may be too early to assume that the era of the petrol engine is coming to an end.

More likely, the oil price will eventually find a bottom and, if this cycle is like previous ones, shoot sharply higher because of the level of underinvestment in reserves and natural depletion of existing wells. Yet the consequences will be different. Antoine Halff of Columbia University’s Centre on Global Energy Policy told American senators on January 19th that the shale-oil industry, with its unique cost structure and short business cycle, may undermine longer-term investment in high-cost traditional oilfields. The shalemen, rather than the Saudis, could well become the world’s swing producers, adding to volatility, perhaps, but within a relatively narrow range.

Big oil firms would then face some existential questions. In the future, should they carry on as before, splurging on expensive vanity projects in hard-to-reach places, at the risk of having “unburnable” reserves as environmental concerns mount? Should they reinvest their profits in shale or in greener technologies? Or should they return profits to shareholders, as some tobacco companies have done, marking the beginning of the end of the fossil-fuel era? Whatever they do, the era of oil shocks is far from over

No comments:

Post a Comment