- 1 hour ago

- Business

THINKSTOCK

THINKSTOCK

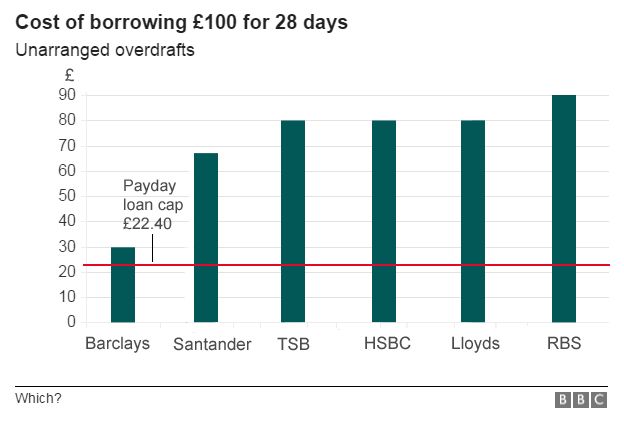

Borrowing money on an unarranged overdraft from your bank can be more expensive than taking out a payday loan, says consumer group Which?

Anyone who borrows £100 for 28 days from a payday lender now faces a maximum charge of £22.40.

But going overdrawn without agreement from your bank can cost as much as £90, according to Which?

The banks argue that unarranged overdrafts should be a last resort, as they offer far cheaper ways to borrow.

Concern about the cost of overdrafts was expressed by Andrew Tyrie, the chair of the Treasury Select Committee, earlier this week.

He wrote to 13 UK High Street banks, asking them to come clean about charges, particularly for unauthorised - or emergency - lending.

"Consumers need to know what they are being charged for their bank accounts, especially their overdrafts," said Mr Tyrie.

"At the moment they often struggle to find out."

Caps on charges

Charges for unauthorised overdrafts vary widely.

Which? compared the cost of borrowing £100 for 28 days.

Royal Bank of Scotland (RBS), which has some of the highest charges, allows customers a £10 buffer, and then charges £6 a day up to a maximum of £90 in any 30 day period.

TSB, Lloyds and HSBC all charge up to £80.

Customers of some Halifax accounts pay £5 a day, up to a maximum of £100.

In 2014, UK banks made £1.2bn from such overdrafts, according to the Competition and Markets Authority (CMA).

The CMA has already proposed a cap on charges, known as a monthly maximum charge (mmc).

However Which? said this was unlikely to make much of a difference, as most banks already have a cap in place.

The CMA's final recommendations are due to be published in August.

Also on the BBC:

In response, the banking industry said that unplanned overdraft charges are much lower than they used to be.

A spokesperson for the British Bankers Association said:

"Across the board overdraft charges have plummeted since 2008, with consumers saving up to an estimated £928 million over the past five years; one bank recently reported its customers are saving £100 million per year as a result of text alerts."

Banks advise their customers to use a planned overdraft facility wherever possible.

HSBC, for example, said borrowing £100 for 28 days through this method would only cost £1.40.

Payday loans have been capped by the Financial Conduct Authority (FCA) since January 2015.

"The regulator has shown it's prepared to take tough action to stamp out unscrupulous practices in the payday loans market, and must now tackle punitive unarranged overdraft charges," said Alex Neill, director of policy and campaigns at Which?

No comments:

Post a Comment